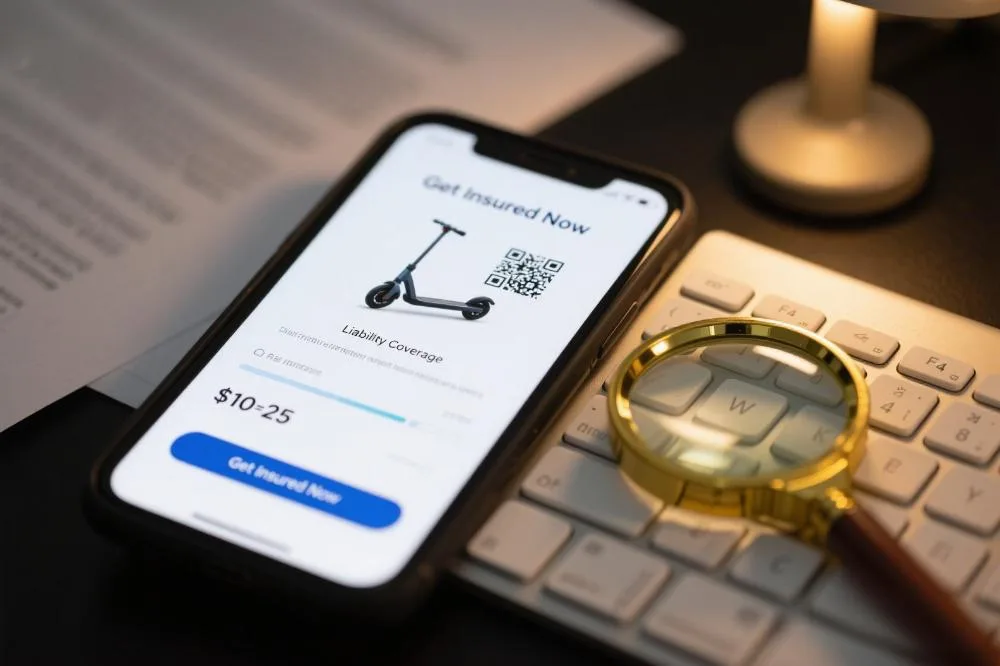

how to get e scooter insurance

As e-scooter adoption continues to surge across Western cities—with EU Transport Commission 2025 data showing 32 million regular users in major urban areas—insurance has become a top consumer concern. Statista’s latest report reveals 67% of Western buyers face difficulties selecting appropriate coverage within their first month of ownership, while insurance-related accident disputes increased by 42% in 2025. This guide systematically explains e-scooter insurance procurement strategies, from legal requirements to claims management, delivering a complete solution. 1. Why You Need E-Scooter Insurance 1. Legal Requirements 2. Practical Risk Protection 2. Insurance Types Explained 1. Basic Liability Coverage 2. Comprehensive Insurance 3. Short-Term Policies 3. Step-by-Step Purchasing Guide Step 1: Assess Needs Step 2: Compare Options Step 3: Prepare Documents Step 4: Key Considerations 4. Claims Management Strategies 1. Accident Protocol 2. Theft Cases 3. Dispute Resolution 5. 2025 Market Trends